Given that the IRS has strict necessities regarding purity and provenance of coins just before buy for an IRA account. Normally validate their IRA metal eligibility first!

This custodian is chargeable for executing all transactions in your account from administrative obligations which include tax reporting to making sure the actual gold is held on the behalf by an approved depository.

When opening just one it’s crucial that you comprehend these regulations along with collaborate with a longtime custodian who will make certain all investments continue being compliant and safe.

For buyers trying to find tangible diversification in an significantly digital and volatile financial landscape, Gold IRAs give a must have protection if performed with one of several best gold IRA companies.

Having said that, we wouldn't suggest this Specific kind of unique retirement account for many traders. For instance, you won’t find a gold IRA option at any of the largest, most reputable brokerage firms.

By legislation, you've got only 60 times to finish this transaction and then the resources come to be taxable on withdrawal. Also, the law allows only just one tax-totally free rollover of IRA resources per year.

I’m glad you’ve discovered the right fit for your needs. We do Feel American Hartford is location new good quality expectations for gold IRA companies.

A superb gold IRA supplier can have an entire booklet that addresses Nearly any dilemma that maybe you have and involves extensive information on the company.

Gold, silver, palladium and platinum bars and rounds produced by a NYMEX or COMEX-accepted refinery or nationwide government mint, as long as they meet up with minimal coin fineness prerequisites.

Be mindful of any tax effects as well as you possibly can penalties related check my source to withdrawing any sum under that age threshold.

Diversification: While gold can provide protection from economic downturns, traders have to diversify their portfolio to minimize unnecessary challenges. Relying exclusively on gold places traders at undue danger.

When personally Keeping and preserving gold IRA assets may possibly seem attractive, IRS restrictions do not allow it. Appointed custodians Perform an priceless position in preserving compliance, safety, as article source well as integrity of gold IRA accounts.

All IRA transactions should be described into the IRS. When marketing gold or other precious metals from a IRA, its custodian should really ship each you and them an IRS Sort 1099-R detailing your distribution – recall this when submitting your yearly taxes!

Cory has been knowledgeable trader for 20 years. As well as trading and investing he is broadly printed and coaches individual shoppers about moved here the finer points of gaining an edge on the market.

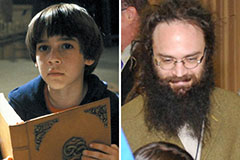

Barret Oliver Then & Now!

Barret Oliver Then & Now! Ross Bagley Then & Now!

Ross Bagley Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!